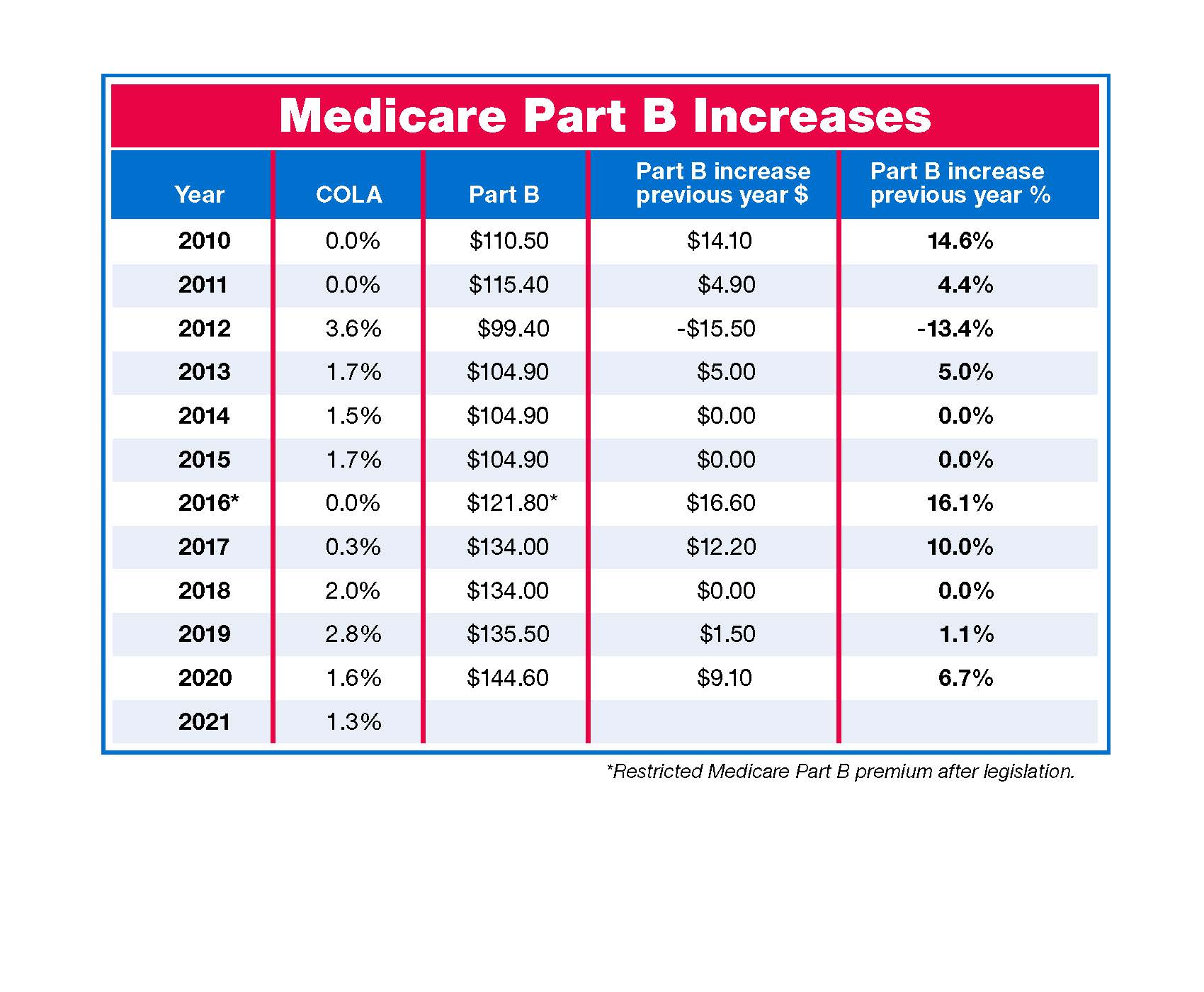

Social Security Tax 2025 Rate - Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act. Social Security Tax 2025 Rate. Education cess is applicable @ 4% on income tax. The most you will have to pay in social security taxes for 2025 will be $10,453.

Each year, the medicare part b premium, deductible, and coinsurance rates are determined according to provisions of the social security act.

How To Calculate, Find Social Security Tax Withholding Social, The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child. An individual who earns under.

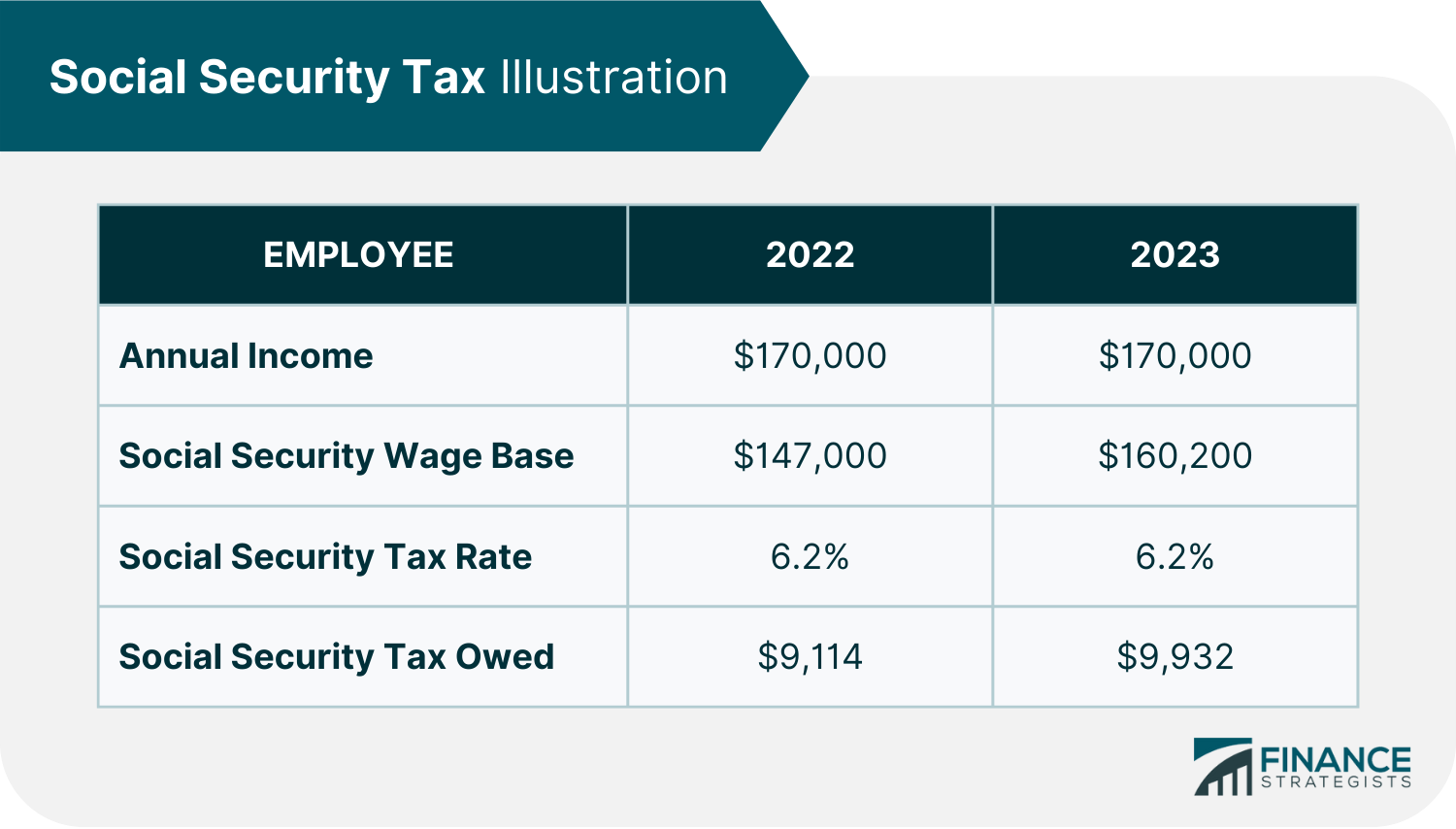

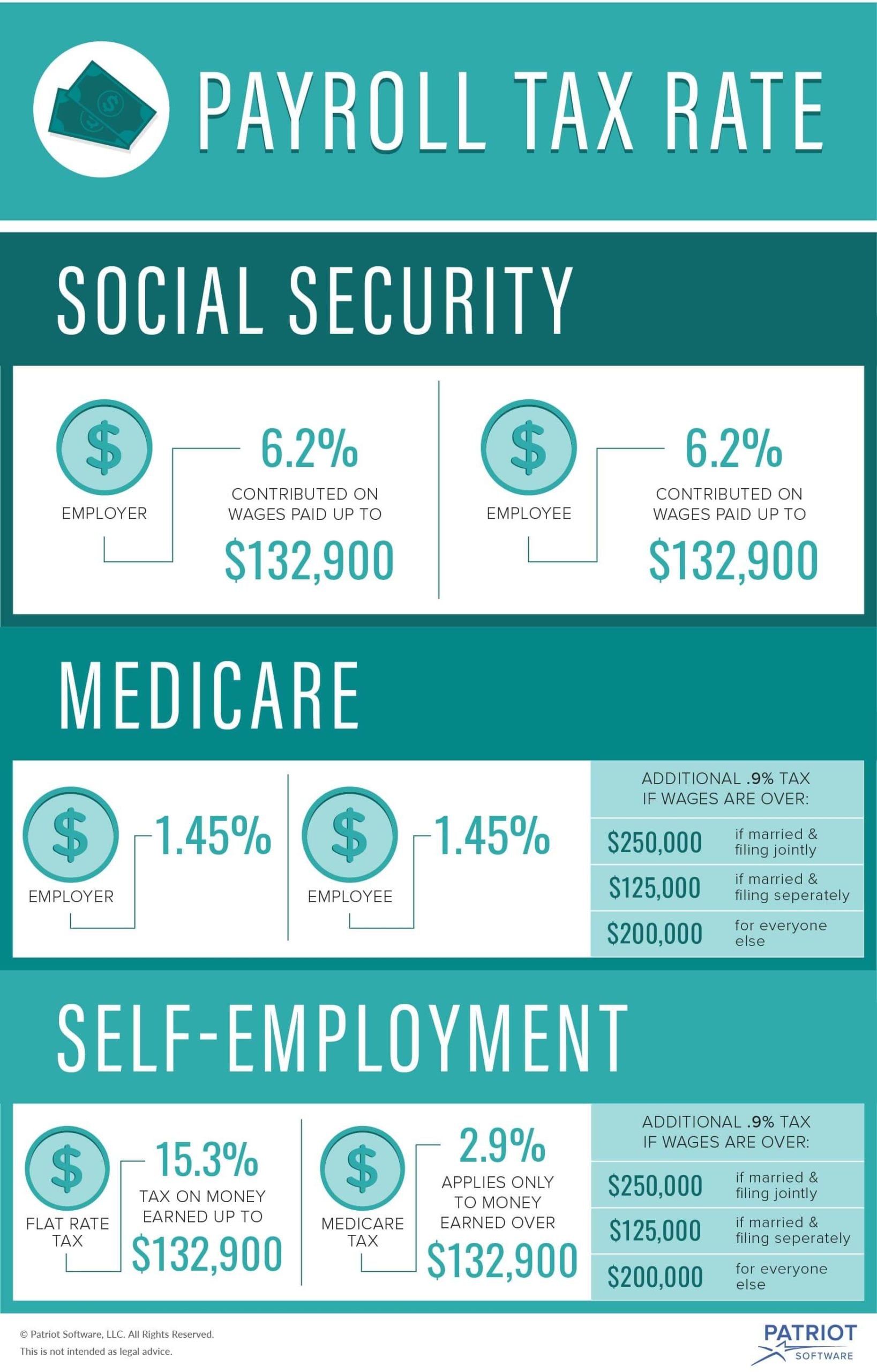

Limit On Social Security Tax 2025 Kelcy Melinde, The social security tax rate for employees and employers is 6.2% of employee compensation each for a total of 12.4%. That’s what you will pay if you earn $168,600 or.

Social Security Tax Brackets 2025 Hedi Raeann, In 2025, only the first $168,600 of your earnings are subject to the social security tax [0]. Eliminate the tax on food sales on april 1 instead of jan.

These are the new Social Security taxes you will have to pay in 2025, For example, if you earned $100,000 in wages in 2025, $6,200 of it will be. Eliminate the tax on food sales on april 1 instead of jan.

Social Security And Medicare Withholding Rates 2025 Hali Prisca, In 2025, only the first $168,600 of your earnings are subject to the social security tax [0]. 50% or 85% of your benefits being taxable doesn’t mean you’ll lose.

Tax rates for the 2025 year of assessment Just One Lap, Eliminate the tax on food sales on april 1 instead of jan. Marginal relief may be available.

Social Security Tax Rate 2025 Zrivo, Education cess is applicable @ 4% on income tax. The social security tax rate is 12.4 percent in total where you and your employer pay 6.2 percent each.

In 2025, only the first $168,600 of your earnings are subject to the social security tax [0].

Social Security Irmaa Brackets 2025 Mufi Tabina, For 2025, the social security tax rate is 6.2% (amount withheld) each for the employer and employee (12.4% total). That’s what you will pay if you earn $168,600 or.

Social Security Employer Tax Rate 2025 Prue Ursala, When you want to know the fica tax rate, you should refer to the two categories below. You file a federal tax return as an individual and your combined income is more than $34,000.

The social security wage base limit is $168,600. The maximum amount of social security tax an employee will have withheld from their.

For example, if you earned $100,000 in wages in 2025, $6,200 of it will be.

Understanding FICA, Social Security, and Medicare Taxes, You will pay tax on your social security benefits based on internal revenue service (irs) rules if you: The most you will have to pay in social security taxes for 2025 will be $10,453.